Does one speeding ticket affect your insurance? Yes, it most certainly does. Speeding tickets affect insurance significantly. Unfortunately, speeding violations rebounded to pre-pandemic levels in late 2020 (1 Lexis Nexis). Insurance companies treat that speeding ticket as a precursor to more serious incidents. The risk of insuring you goes up with your first speeding ticket, so your premiums go up.

Did you ever wonder how much that one speeding ticket affects your insurance? Probably a whole lot more than you expect. In addition to the actual fine for the speeding ticket, a 2022 study done by the Zebra insurance group across various insurance companies found that a speeding ticket causes your insurance to go up 30% (2 Zebra Study). Is the rush to the office worth it? Interested in personal finance content like this?

Your insurance company will likely take quick action based on the higher risk profile due to your speeding. These actions could include:

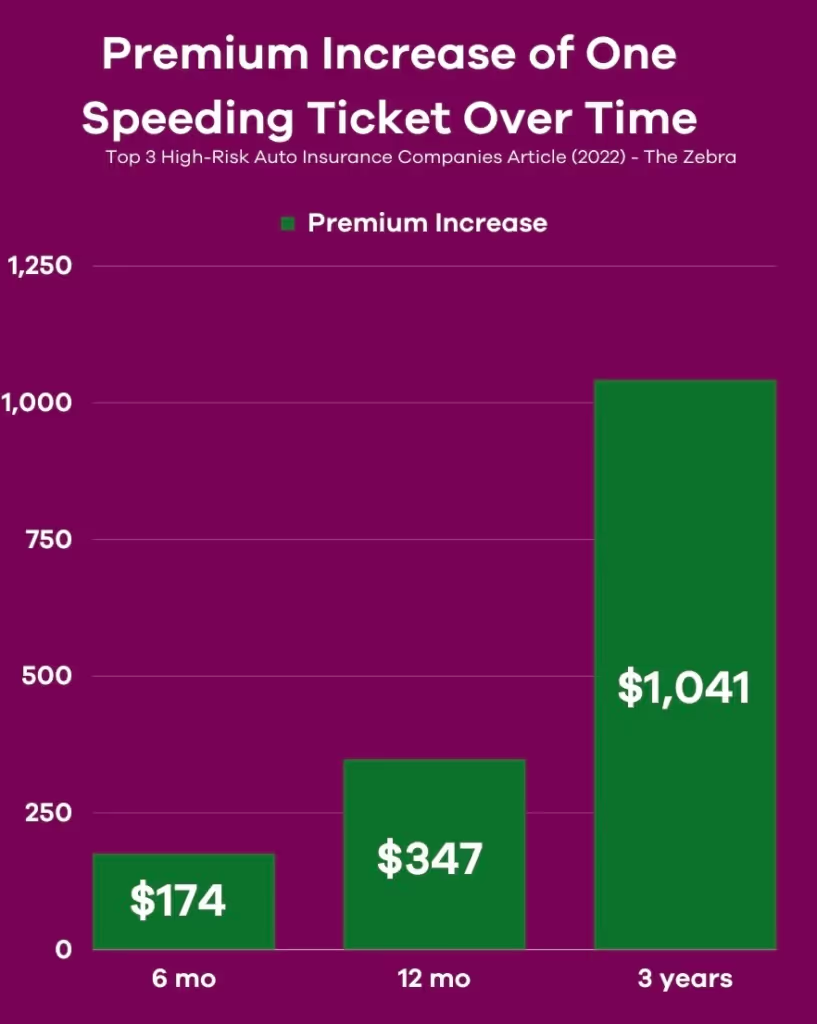

It’s a direct link! Speeding tickets affect insurance with costs going up once it posts to your driving record.

The insurance premiums that you pay are based on your driving record. In particular, insurance companies look for accidents and also speeding tickets that are on your record. Speeding tickets are a major cause of traffic accidents. When you speed and are caught, you really receive two things at once; a speeding ticket and insurance increase. The insurance company sees a speeder as a higher risk individual that may cause a future accident which would result in a claim and paying out thousands of dollars. To compensate for this higher risk and payout, the insurers increase the cost of your insurance premiums. The more traffic violations you have, the more likely it is you'll see increases in the cost of insurance, according to the Insurance Information Institute (3).

Some other factors that are considered when determining rate increases after a speeding ticket:

In contrast, a safe driver with a spotless record with no accidents and without any speeding violations is lower risk; lower probability of payout for the insurance provider. Many times driving safely results in “Safe Driver” discounts; often touted in many commercials.

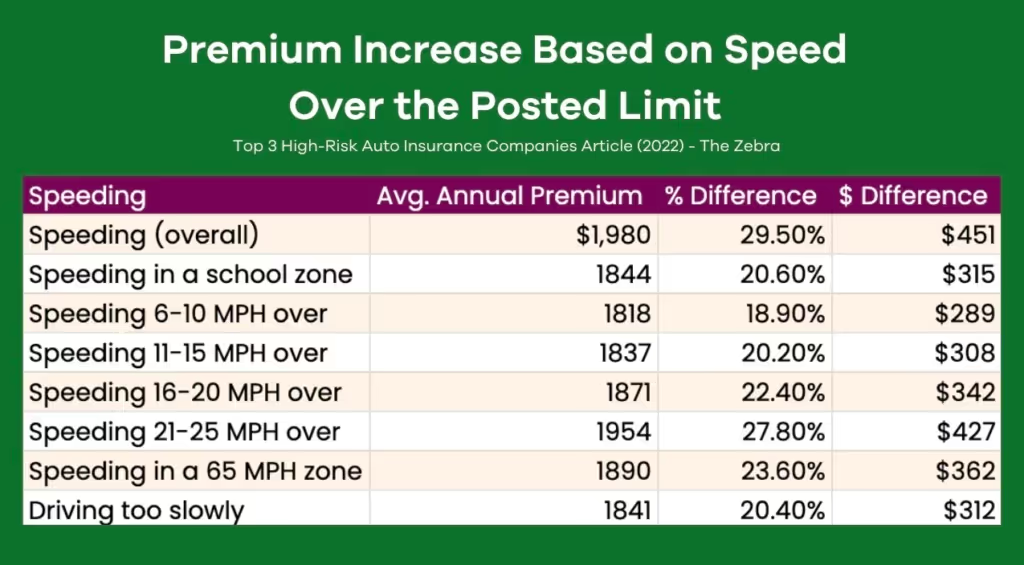

Your insurance can go up about 30% once a speeding ticket posts to your driving record, based on a 2022 study by the Zebra insurance group. There is a chart below from the Zebra study that shows the increase based on speed over the posted limit. Believe it or not, you can actually get a ticket for driving too slow and that would result in about a 20% increase in your insurance rates.

But wait, if it is determined that your speeding was connected with another vehicle and becomes a racing violation, your increase could more than double to around 65% higher insurance premiums and that’s only if your insurance company will renew your policy. The only violation more expensive than Racing is a Hit and Run violation with an average 70% increase.

There are several things you can do to lower your car insurance after receiving a speeding ticket. If this is your first ticket in awhile, you can try to keep it from going on your driving record with these three ideas:

By successfully completing one of the above, the ticket stays off your record and you avoid years of higher premiums.

Maybe it is time to slow down and avoid the rush. The alternative is a significant increase in insurance costs and more likely causing an accident and hurting others. Safer driving avoids all of this, prevents the hassle of court appearances and decreases insurance costs. Keep the money in your pocket. It’s better to save than pay! Check out the personal finance content on Your Money Line website including courses on budgeting and investing or send us a note.

Cited Sources:

3. Do auto insurance premiums go up after a claim? Insurance Information Institute, Do auto insurance premiums go up after a claim? | III

Steven Gay, AFC®️, is a Financial Guide dedicated to helping individuals and families achieve stability and stewardship in their financial lives. Steven has been working with households since 2009 guided by a strong belief in the power of budgeting as the foundation of financial success. He specializes in debt reduction, goal-based saving, and retirement planning. His compassionate counseling style combines financial expertise with empathy, empowering clients to take control of their finances and reduce stress.

Follow and connect with the author on LinkedIn