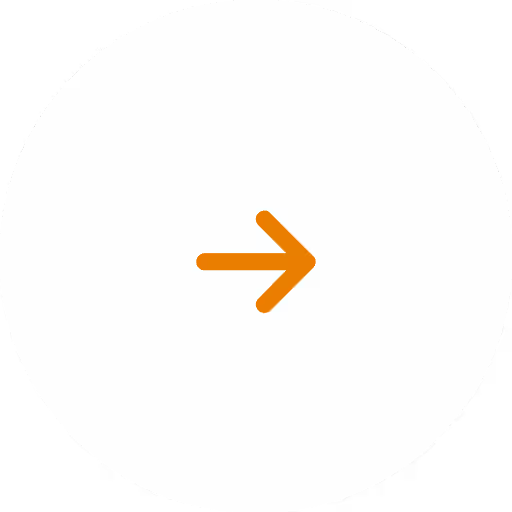

What are wellness dollars?

Wellness dollars represent funds set aside by insurance companies specifically for employee health initiatives. These are used outside the standard benefits package going beyond retirement, healthcare, PTO, etc., providing a unique opportunity for employers to invest in the well-being of their teams and to attract and retain top talent.

Below is a step-by-step guide to determine if you have wellness dollars, how to access them, and how to maximize them to improve the health and well-being of your employees.

Step 1: Accessing wellness dollars

The first step is determining if your company has access to wellness dollars. Start by asking your health insurance provider if they offer wellness dollars and if your organization can access them. If your insurance does provide wellness dollars, ask what types of programs are eligible because each insurer has different criteria for qualifying programs

The availability of wellness dollars depends on factors like plan type, company size, number of employees, and overall employee health.

Step 2: Using wellness dollars

These funds can be used across various corporate wellness programs, offering a fantastic way for companies to attract and retain top talent through free wellness initiatives.

Common uses for wellness dollars:

- Financial wellness programs: Provide a financial wellness benefit (like Your Money Line) offering 1:1 personalized coaching, education, technology, and more to improve the financial confidence and stability of your employees.

- Gym memberships: Cover the cost of a gym membership at participating fitness centers.

- Weight loss programs: Get reimbursed for the fees of select weight loss programs.

- Smoking cessation plans: Quit smoking for good with reimbursement for nicotine gum/patches or counseling programs.

- Fitness trackers: Purchase activity trackers, like Fitbits, and get money back.

- Health coaching: Work one-on-one with a certified health coach and receive reimbursement for sessions.

- Preventative care: Pay for eligible preventative medical costs like annual exams, vaccines, and cancer screenings.

- Mindfulness apps: Cover subscriptions to approved meditation and mindfulness apps, like Headspace.

- Massage therapy: Relieve stress and anxiety with reimbursement for therapeutic massage sessions.

- Yoga classes: Take yoga at participating studios and get reimbursed for the fees.

Step 3: Maximizing wellness dollars:

- Setting wellness goals

The ultimate aim of wellness dollars is to foster healthier lifestyles among employees, reducing the need for insurance claims and promoting a vibrant, energetic workplace.

- Survey and strategize

Engage with your team to find out what wellness programs they are interested in and strategize on how to allocate the funds effectively. Seeking out wellness program vendors that align with your organization’s goals is crucial.

- The ROI of wellness

Investing in wellness dollars is not just a commitment to employee health—it’s a wise financial decision. Companies can see a return on investment of up to $3.80 for every dollar spent on wellness initiatives, leading to improved engagement, a competitive benefits package, and a healthier bottom line.

Do you want help crafting your wellness program and using your dollars effectively? Reach out to one of our wellness experts today!